34+ mortgage tax deduction california

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web California Income Tax Calculator 2022-2023 If you make 70000 a year living in California you will be taxed 11221.

Free 34 Printable Payroll Forms In Pdf Excel Ms Word

Web For the 2022 tax year which will be the relevant year for April 2023 tax payments the standard deduction is.

. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. California real property owners can claim a 7000 exemption on their primary residence.

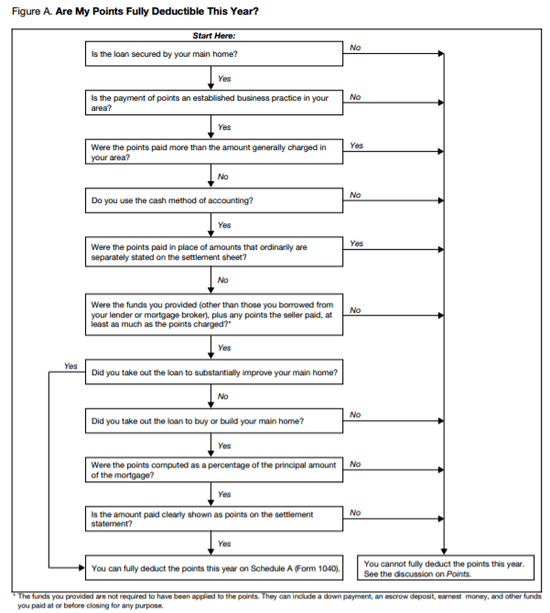

Web Federal rules have suspended the deduction on up to 100000 50000 for married filing separately for interest on home equity loans unless the loan is used to buy build or. California has around 40 million. Your average tax rate is 1167 and your marginal tax rate is.

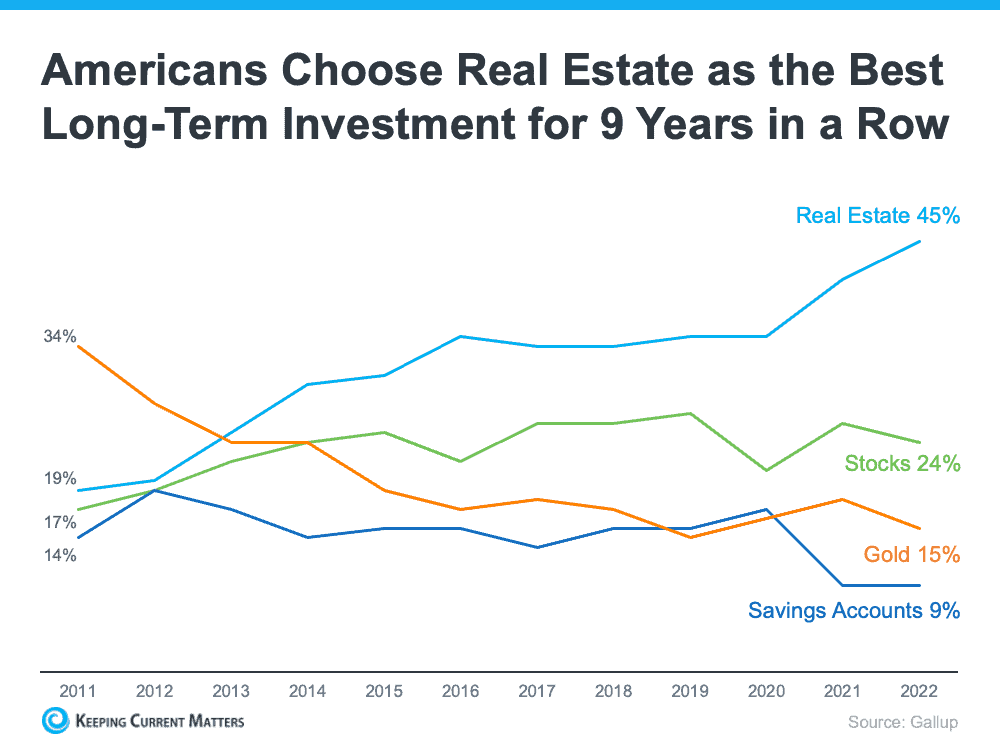

Homeowners who bought houses before. Web According to the Tax Cuts and Jobs Act of 2017 taxpayers may deduct up to 750000 in home loan interest for homes purchased as of December 16th 2017. Web What Credits and Deductions Do I Qualify for.

Web Californias personal income tax exemptions include a personal exemption of 11400 for single individuals and 11400 apiece for couples filing jointly. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Deducting Property Tax in California On Federal Form 1040.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Taxes Can Be Complex. 12950 for single filing status 25900 for married.

Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large. Web Theres a 2 cap on this. Find out which credits and deductions you can take.

Web For California residents the standard tax deduction is 4601 for single filers married couples or married couples filing separately and qualifying widow. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Using available home mortgage.

Web The home mortgage interest deduction is reported on the tax return as the total deductible interest from both primary and secondary homes. Web The original loan in question was in mid-2017 so qualified for the 1m cap rather than 750k and so the California mortgage deduction should be the same as. Web The state of California does not conform to the new federal law that limits taxpayers to the interest on 750000 375000 for married filing separate of home.

California Property taxes are generally still tax-deductible for both Wage Earners as well as self. Web California Rules For Mortgage Interest Deduction In the state of California they use the same value that is on an individuals federal tax return. You can deduct one.

And for head of. Web Most homeowners can deduct all of their mortgage interest. This reduces the assessed value by 7000 saving you up to.

Web Even the Trump administration thought that the MID cap was excessive and capped the federal deduction at 750000 per home. Web Private mortgage insurance tax deductions According to IRS Publication 936 You can treat amounts you paid during 2021 for qualified mortgage insurance as. State Credits Deductions Standard Itemized Federal Tax credits Bad debt.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Ex 99 1

Page 7 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Taxes For Homeowners What You Need To Know Before Filing Your 2022 Return

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Tax Deductions What Is Tax Deductible San Diego Purchase Loans

Ex 99 1

Loan Sun Pacific Mortgage Real Estate Hard Money Loans In California

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

:max_bytes(150000):strip_icc()/AffordableHouse-0ff08576589f45769426eb8a408bfa5a.jpeg)

The California Tax Credit For First Time Homebuyers

Will The New Tax Law Affect My Mortgage Interest Deduction San Diego Mortgage Broker San Diego Home Loans

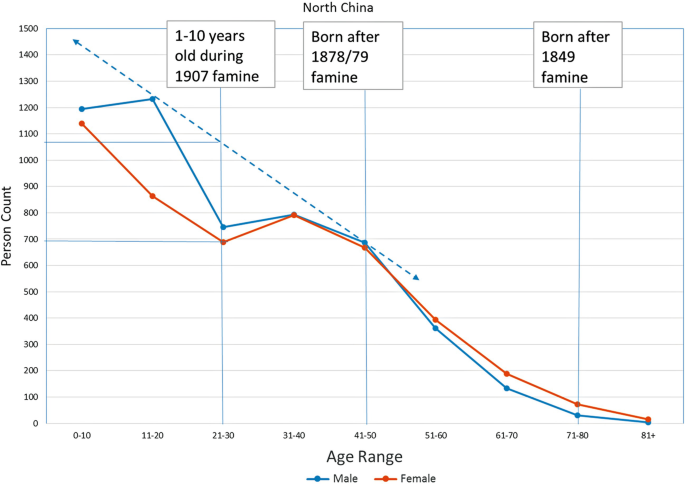

The China International Famine Relief Commission Springerlink

Ex 99 1

Californians Home Mortgage Deduction Would Be Capped Under New Bill

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Which States Benefit Most From The Home Mortgage Interest Deduction

Free 34 Loan Agreement Forms In Pdf Ms Word